All Categories

Featured

Table of Contents

You can lose a great deal of time and money using data that is incorrect or out of day. Individuals browse software will certainly offer greater high quality data for your service. Examination BellesLink information for yourself. When you intend to search a checklist of people, Batch Search is the tool to make use of because you can can browse hundreds of records simultaneously and returned in-depth search results page with current contact number, addresses, and e-mails.

Conserve time by looking thousands of documents at one time, rather of specific searches. When you need to do a total search to discover contact info for a specific, their loved ones, neighbors and associates, you'll desire to utilize people searches.

Information from your people searches can be conserved right into a contact record. In all the talk about information and searches, it's very easy to forget why businesses utilize people look tools in the first area, the factor is to make contact with the person by phone, text, and email.

Foreclosure Due To Back Taxes

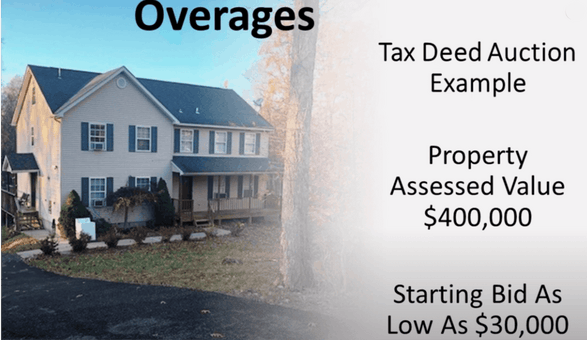

Every now and then, I hear discuss a "secret brand-new opportunity" in business of (a.k.a, "excess proceeds," "overbids," "tax obligation sale excess," etc). If you're completely unknown with this concept, I wish to provide you a fast summary of what's going on below. When a residential property owner stops paying their building taxes, the local community (i.e., the region) will await a time prior to they confiscate the home in foreclosure and market it at their annual tax sale auction.

utilizes a similar design to recoup its lost tax obligation revenue by marketing residential or commercial properties (either tax acts or tax liens) at an annual tax sale. The details in this post can be influenced by numerous unique variables. Always talk to a certified lawyer before acting. Intend you possess a residential property worth $100,000.

Over The Counter Tax Lien

At the time of repossession, you owe concerning to the county. A few months later on, the region brings this home to their annual tax obligation sale. Here, they market your home (along with loads of other delinquent homes) to the highest possible bidderall to redeem their lost tax obligation income on each parcel.

This is since it's the minimum they will certainly require to redeem the cash that you owed them. Below's things: Your residential or commercial property is quickly worth $100,000. A lot of the investors bidding on your property are completely mindful of this, also. In most cases, residential or commercial properties like your own will certainly receive quotes much past the quantity of back taxes really owed.

Tax Defaulted Properties Sale

Obtain this: the region just needed $18,000 out of this residential property. The margin in between the $18,000 they required and the $40,000 they obtained is referred to as "excess profits" (i.e., "tax obligation sales excess," "overbid," "excess," etc). Numerous states have statutes that restrict the region from maintaining the excess repayment for these residential or commercial properties.

The county has guidelines in area where these excess profits can be claimed by their rightful owner, typically for a marked period (which differs from state to state). And that exactly is the "rightful owner" of this money? It's YOU. That's appropriate! If you shed your home to tax obligation foreclosure since you owed taxesand if that residential or commercial property subsequently cost the tax sale auction for over this amountyou might feasibly go and gather the difference.

This includes verifying you were the previous owner, finishing some documentation, and waiting for the funds to be delivered. For the average individual who paid full market worth for their home, this approach does not make much feeling. If you have a significant amount of cash invested into a residential or commercial property, there's means also much on the line to simply "let it go" on the off-chance that you can bleed some extra money out of it.

With the investing method I use, I can get buildings cost-free and clear for cents on the dollar. When you can purchase a residential or commercial property for an unbelievably affordable cost AND you understand it's worth significantly even more than you paid for it, it might really well make sense for you to "roll the dice" and attempt to collect the excess profits that the tax repossession and public auction procedure produce.

While it can certainly turn out similar to the means I have actually defined it above, there are additionally a few drawbacks to the excess profits approach you truly ought to know - default property tax. While it depends substantially on the characteristics of the home, it is (and in some situations, most likely) that there will certainly be no excess earnings produced at the tax obligation sale public auction

Buying Tax Forfeited Land

Or probably the county does not generate much public passion in their auctions. In either case, if you're purchasing a home with the of letting it go to tax obligation repossession so you can gather your excess profits, what if that money never comes via? Would certainly it deserve the time and cash you will have thrown away as soon as you reach this conclusion? If you're expecting the county to "do all the job" for you, then presume what, In most cases, their routine will literally take years to turn out.

The very first time I sought this approach in my home state, I was told that I really did not have the option of asserting the surplus funds that were generated from the sale of my propertybecause my state really did not enable it. In states similar to this, when they produce a tax sale overage at an auction, They just keep it! If you're assuming concerning utilizing this method in your business, you'll want to think lengthy and tough concerning where you're working and whether their legislations and laws will certainly even permit you to do it.

Government Tax Foreclosures

I did my ideal to offer the correct answer for each state over, but I would certainly advise that you before continuing with the assumption that I'm 100% appropriate. Remember, I am not a lawyer or a CPA and I am not attempting to break down specialist legal or tax advice. Talk with your attorney or CPA before you act upon this info.

The reality is, there are thousands of auctions all over the nation yearly. At numerous of these auctions, hundreds (or perhaps thousands) of capitalists will certainly show up, get involved in a bidding process battle over most of the residential properties, and drive costs WAY greater than they must be. This is partly why I've never been a big follower of tax sale auctions.

Check its precision with a third-party specialist before you start). Get a overdue tax list. There are a couple of methods to do this (another of which is defined below). Send a direct-mail advertising campaign (ideally, a couple of months from the foreclosure date, when inspired sellers are to dump their home for next-to-nothing rates).

Play the waiting game up until the building has been foreclosed by the area and offered and the tax sale.

Pursuing excess profits uses some pros and cons as a service. There can be some HUGE upside potential if and when the stars straighten in your favorthey seriously need to in order to attain the finest possible outcome.

Foreclosure Overages List

There is the opportunity that you will gain nothing in the end. You might lose not just your cash (which with any luck won't be very much), however you'll additionally shed your time too (which, in my mind, deserves a lot a lot more). Waiting to collect on tax obligation sale excess requires a great deal of resting, waiting, and expecting outcomes that usually have a 50/50 possibility (on average) of panning out favorably.

If this sounds like a service possibility you desire to dive right into (or at the very least discover more regarding), I understand of one individual that has developed a full-blown training course around this certain sort of system. His name is and he has actually explored this realm in excellent detail. I have been with a couple of his training courses in the past and have actually discovered his techniques to be extremely effective and reputable money-making approaches that function very well.

A Tax Obligation Sale Overages Business is the excellent service to run out of your home. If you are trying to find a way to supplement your income, which can at some point develop into a permanent profession, then this can be for you. All you really need to obtain started is an Office with the complying with things: Computer system with Web Connection Printer Cellular Phone Miscellaneous Workplace SuppliesThis book will certainly stroll you through the procedure of beginning and running this kind of company, step-by-step, as well as, to talk about the very best means to tackle getting these Tax obligation Sale Overages for your clients while making money for your initiatives.

Latest Posts

Tax Defaulted Property For Sale

Tax Sale Foreclosure Property

Houses Sold For Back Taxes