All Categories

Featured

A financial investment vehicle, such as a fund, would certainly have to figure out that you qualify as a certified capitalist (investor guidelines). The advantages of being a recognized capitalist consist of access to one-of-a-kind investment chances not available to non-accredited capitalists, high returns, and raised diversification in your portfolio.

In certain regions, non-accredited capitalists also can rescission (accredited investor solutions). What this suggests is that if a financier chooses they desire to take out their money early, they can claim they were a non-accredited investor during and get their cash back. Nevertheless, it's never ever an excellent idea to give falsified records, such as fake income tax return or financial declarations to a financial investment vehicle just to spend, and this might bring lawful trouble for you down the line - pre ipo for non accredited investor.

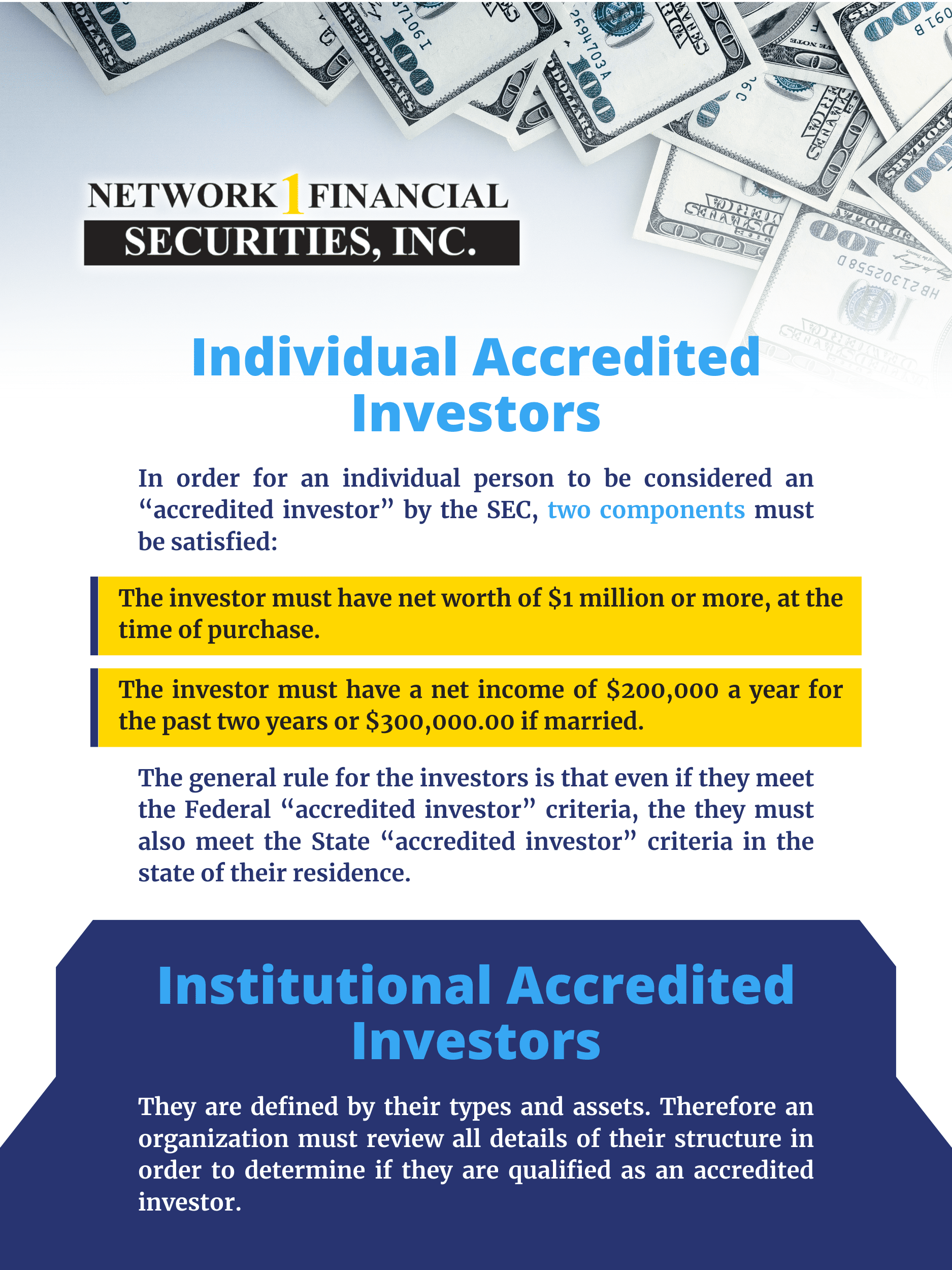

That being stated, each deal or each fund might have its own restrictions and caps on financial investment quantities that they will certainly accept from a financier (a qualified investor). Accredited capitalists are those that fulfill specific requirements regarding income, credentials, or web worth. They are normally affluent people (investor qualifications). Recognized capitalists have the possibility to buy non-registered financial investments supplied by firms like personal equity funds, hedge funds, angel investments (how to be an accredited investor), financial backing firms, and others.

Latest Posts

Tax Defaulted Property For Sale

Tax Sale Foreclosure Property

Houses Sold For Back Taxes